Lipid Nutrition Market Size to Worth USD 39.20 Billion by 2035 | Towards FnB

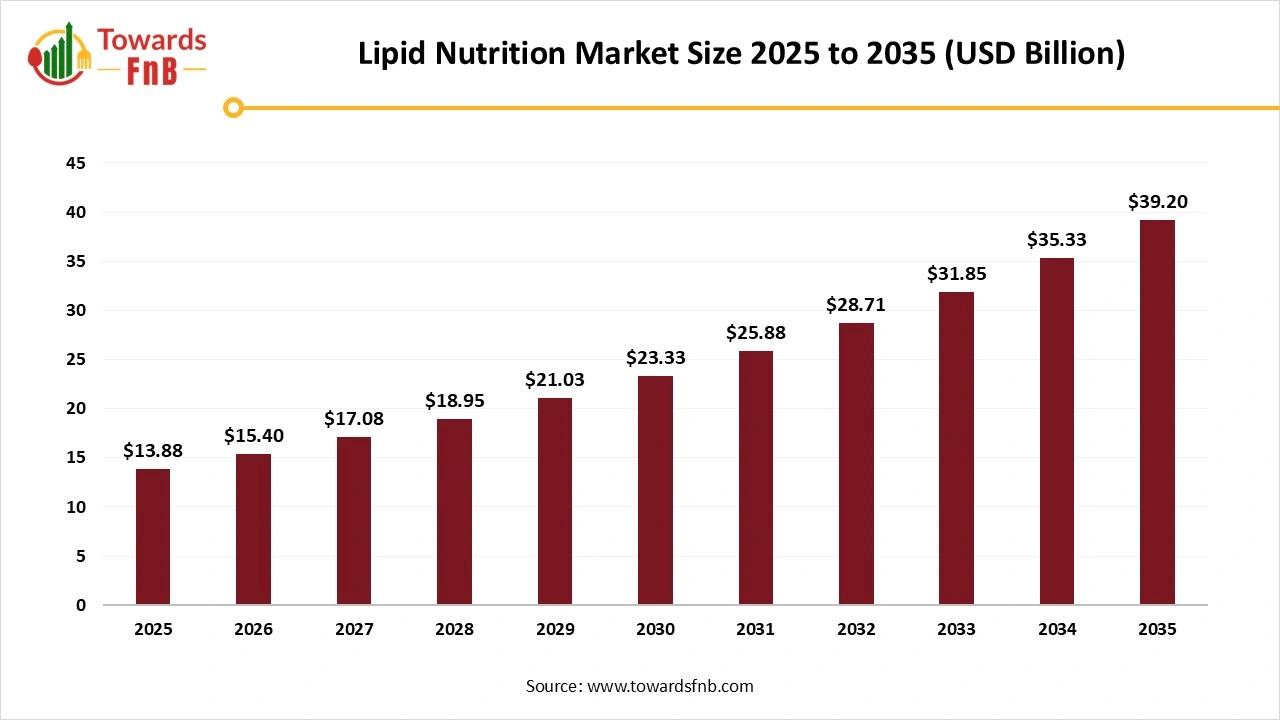

According to Towards FnB, the global lipid nutrition market size is calculated at USD 15.40 billion in 2026 and is expected to reach USD 39.20 billion by 2035, reflecting at a CAGR of 10.94% from 2026 to 2035. This growth outlook highlights the expanding role of lipid-based ingredients across dietary supplements, infant nutrition, medical foods, and functional food and beverage applications.

Ottawa, Jan. 19, 2026 (GLOBE NEWSWIRE) -- The global lipid nutrition market size stood at USD 13.88 billion in 2025 and is predicted to grow from USD 15.40 billion in 2026 to reach around USD 39.20 billion by 2035, according to a report published by Towards FnB, a sister firm of Precedence Research. The market’s steady expansion from its 2025 base reflects increasing commercialization of advanced lipid formulations, improved bioavailability technologies, and wider adoption by food and nutrition manufacturers globally.

The market is expected to grow due to the increasing importance of healthy fats, which offer multiple health benefits and cater to the demand of consumers with specific health requirements. Higher demand for functional and fortified food and beverage options is another key factor driving the industry's growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5975

Key Highlights of Lipid Nutrition Market

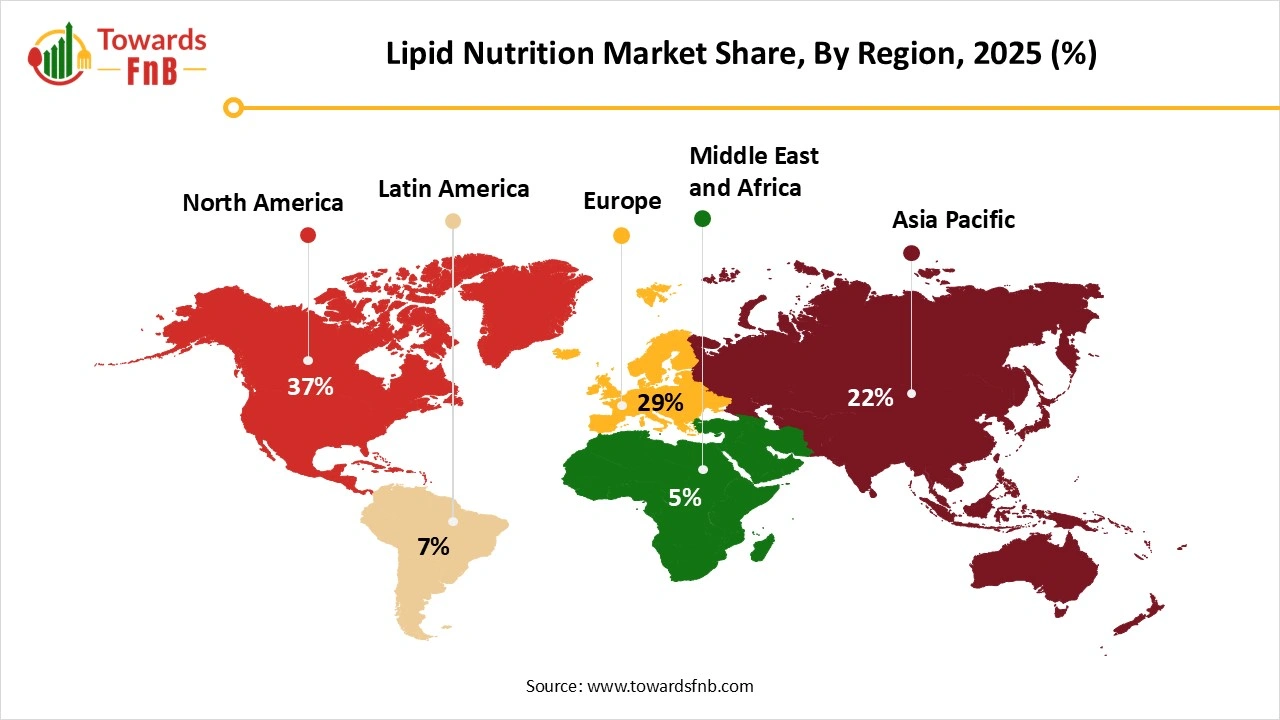

- By region, North America led the lipid nutrition market with highest share of 37% in 2025, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By type, the omega-3 segment led the lipid nutrition market in 2025, whereas the medium-chain triglycerides segment is expected to grow in the foreseeable period.

- By source, the animal source segment dominated the lipid nutrition market in 2025, whereas the plant source segment is expected to grow in the foreseeable period.

- By form, the liquid segment led the lipid nutrition market in 2025, whereas the powder segment is expected to grow in the foreseeable period.

- By application, the dietary supplements and nutraceutical segment led the lipid nutrition market in 2025, whereas the infant formula segment is expected to grow in the foreseeable period.

“Lipid nutrition is transitioning from a niche supplementation category to a core component of preventive healthcare and functional food strategies. Innovation in bioavailability, sustainability, and clinical positioning will define competitive advantage over the next decade,” said Vidyesh Swar, Principal Consultant at Towards FnB.

Rising Lifestyle-related Health Issues Propelling the Growth of the Lipid Nutrition Industry

The lipid nutrition market is expected to grow due to rising lifestyle-related health issues, along with rising demand for preventive healthcare, fueling the growth of the market. A growing number of consumers with the aim of losing weight or consumers facing cardiovascular issues also demand lipid nutrition-enriched products, further fueling the growth of the market. Growing attention towards infant and maternal care to enhance their immunity and keep them protected from various chronic health issues is another vital factor for the growth of the market.

Role of Technology in the Growth of Lipid Nutrition Market

Technologies such as advanced microencapsulation help to improve the stability, taste masking, and bioavailability, which are helpful for the growth of the market. Technological advancements leading to the availability of products such as plant-based lipids and algal-enriched nutrition also help to fuel the growth of the market. Improved purification and concentration processes with the help of technological advancements for improved potency lipid ingredients also help to fuel the growth of the market.

Impact of AI in the Lipid Nutrition Market

Artificial intelligence is increasingly used in the lipid nutrition market to enhance formulation precision, clinical relevance, and supply-chain efficiency across dietary supplements, infant nutrition, medical foods, and functional food applications. Machine learning models analyze complex datasets covering fatty acid composition, bioavailability, oxidation stability, and metabolic response to design lipid blends that meet specific nutritional targets such as omega-3 enrichment, balanced omega-6 to omega-3 ratios, and improved absorption. In product development, AI accelerates the screening of lipid sources, including fish oil, algal oil, and structured lipids, by predicting sensory impact, shelf-life stability, and compatibility with different delivery formats such as powders, emulsions, and soft gels. AI-driven process optimization tools are applied during refining, encapsulation, and emulsification to monitor parameters such as oxygen exposure, temperature, and particle size, reducing oxidation risk and batch variability.

From a quality and compliance perspective, AI supports predictive stability modeling and contaminant risk assessment by correlating processing conditions and raw material data with outcomes such as peroxide value drift or off-flavor development, aligning with nutritional safety and labeling guidance referenced by the Food and Agriculture Organization and regulatory frameworks overseen by the European Food Safety Authority. Overall, AI acts as a formulation optimization and risk-control layer in the lipid nutrition market, enabling manufacturers to deliver clinically positioned, stable, and high-quality lipid-based nutrition products while managing cost, compliance, and performance expectations.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/lipid-nutrition-market

Recent Developments in the Lipid Nutrition Market

- In April 2025, Arla Foods Ingredients initiated a campaign to highlight the benefits of milk fat globule membrane (MFGM) beyond the infant formula category. The campaign followed a Danish Veterinary and Food Administration ruling confirmation defining that MFGM was not classified as a novel food in the EU.

- In January 2026, Marks and Spencers announced that the brand will launch a new range of ‘nutrient-dense’ food for people who have reduced appetites due to taking weight loss jabs.

New Trends of Lipid Nutrition Market

- Higher demand for functional and preventive healthcare products enriched with omega-3 and other lipids is one of the major factors for the growth of the market.

- Higher demand for plant-based and sustainable options, highly demanded by vegans and vegetarians, also helps to fuel the growth of the market.

- Improved bioavailability, taste, and stability with the help of advanced technology also help to fuel the growth of the market.

Product Survey of the Lipid Nutrition Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Omega-3 Fatty Acids | Long-chain polyunsaturated fatty acids supporting cardiovascular, cognitive, and metabolic health | EPA, DHA from fish oil, algal oil | Dietary supplements, functional foods, infant nutrition | Marine- and algae-derived omega-3 oils |

| Medium-Chain Triglycerides (MCTs) | Rapidly metabolized lipids used for energy and fat management | C8, C10 MCT oils and powders | Sports nutrition, clinical nutrition, keto products | Purified MCT oil systems |

| Structured Lipids | Tailored triglycerides designed for targeted absorption or functionality | Interesterified lipids, designer triglycerides | Medical nutrition, infant formula | Structured lipid nutrition systems |

| Phospholipids | Functional lipids supporting cell membrane integrity and emulsification | Lecithin, phosphatidylcholine | Infant nutrition, supplements, functional foods | Food-grade phospholipid ingredients |

| Conjugated Linoleic Acid (CLA) | Bioactive fatty acids associated with body composition support | CLA oil blends | Weight management supplements | CLA nutritional lipid products |

| Short-Chain Fatty Acids Precursors | Lipid substrates supporting gut health via microbial metabolism | Butyrate salts, lipid-bound SCFA precursors | Clinical nutrition, gut-health products | Gut-health lipid formulations |

| Plant-Based Nutritional Oils | Oils providing essential fatty acids from botanical sources | Flaxseed oil, canola oil, sunflower oil | Functional foods, vegan nutrition | Cold-pressed nutritional oils |

| Encapsulated Lipid Ingredients | Lipids protected for stability and controlled release | Spray-dried powders, microencapsulated oils | Beverages, supplements, fortified foods | Encapsulated lipid nutrition systems |

| Infant Nutrition Lipids | Lipids formulated to mimic human milk fat composition | OPO lipids, DHA-enriched blends | Infant formula manufacturers | Human milk fat analogs |

| Clinical Nutrition Lipids | Lipid emulsions designed for medical and therapeutic use | IV lipid emulsions, oral medical lipids | Hospitals, clinical nutrition providers | Medical-grade lipid emulsions |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5975

Lipid Nutrition Market Dynamics

What are the Growth Drivers of the Lipid Nutrition Market?

Factors such as growing health and wellness awareness, higher demand for fortified foods and beverage options, growing preventive healthcare, and higher demand for nutritional supplements are some of the major factors fueling the growth of the market. Growing infant and maternal nutrition globally, leading to higher demand for lipid and omega-3-enriched supplements and infant formula, is also one of the major drivers of the market.

Higher Cost and less availability obstruct the Growth of the Market

Higher costs of fish oil and krill oil are one of the major restrictions in the growth of the market, leading to higher costs of the final product as well. Easy availability of vegan and vegetarian nutrient-dense options with high production costs and limited scalability also restrains the growth of the market.

Higher Demand for Plant-Based and vegan options is aiding the growth of the Lipid Nutrition Market

The growing population of health-conscious consumers, vegetarians, and vegans, leading to higher demand for plant-based lipid options such as algae and other fortified options, is one of the major opportunities for the growth of the market. Higher demand for clean-label and sustainable options by health-conscious consumers is also one of the major opportunities for the growth of the market.

Lipid Nutrition Market Regional Analysis

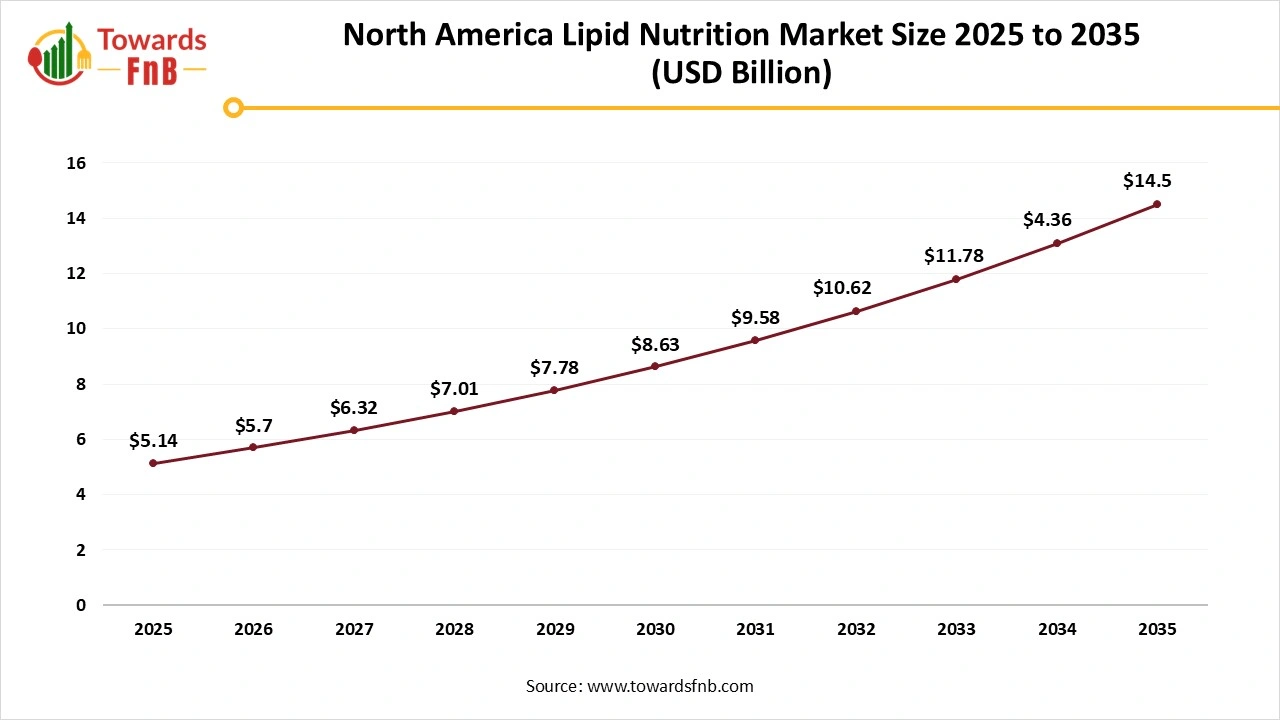

North America Dominated the Lipid Nutrition Market in 2025

North America led the lipid nutrition market in 2025, due to the growing population of health conscious consumers in the region. Higher demand for different types of nutritional supplements enriched with various forms of lipids and omega-3 is another major factor for the growth of the market. Higher demand for innovation options and regulatory support also helps to fuel the market’s growth. The US has a major contribution to the growth of the market due to the rising preventive healthcare trend and higher demand for MCT and omega-3-enriched supplements.

Asia Pacific is observed to be the fastest-growing region in the Foreseen Period

Asia Pacific is observed to be the fastest-growing region due to growing health and wellness awareness in the form of higher demand for fortified options. Such options are enriched with omega-3 and lipids, further fueling the growth of the market. Higher demand for fortified products and supplements due to growing lifestyle-related health issues also elevates the growth of the lipid nutrition market in the foreseeable period. India has a major contribution in the growth of the market due to the rising number of health conscious people and higher demand for fortified options.

Europe is observed to have a Notable Growth in the Foreseen Period

Europe is observed to have a notable growth in the foreseen period due to the strong regulatory framework of the region. Higher demand for plant-based preventive healthcare options by vegans and vegetarians also helps to fuel the market’s growth. Higher demand for fortified and clean-label options is another major factor for the growth of the market. Germany has a major contribution in the growth of the market due to higher consumption of plant-based lipid options, sustainability, and fortified options, along with higher demand for nutraceuticals and other supplements.

Trade Analysis for the Lipid Nutrition Market

What Is Actually Traded (Product Forms and HS Proxies)

- Omega-3 fatty acids, including fish oil, algal oil, and concentrated EPA/DHA preparations used in nutrition and supplements, are commonly traded under HS 1504 and HS 2106 depending on concentration and formulation.

- Medium-chain triglycerides (MCT oils) derived from coconut or palm kernel oil and used in clinical and sports nutrition are typically classified under HS 1516 or HS 1517 depending on chemical modification.

- Structured lipids and specialty triglycerides formulated for infant, medical, and functional nutrition applications are generally cleared under HS 1518 or HS 2106 when supplied as nutritional preparations.

- Phospholipids and lecithins, including soy and sunflower lecithin used for lipid delivery and emulsification, are commonly traded under HS 2923 or HS 2106 depending on purity and application.

-

Encapsulated lipid nutrition ingredients, including spray-dried or beadlet forms for stability and bioavailability, are usually classified under HS 2106.

Top Exporters (Supply Hubs)

- United States: Major exporter of concentrated omega-3 oils, encapsulated lipid ingredients, and specialty nutrition lipids supported by advanced processing and formulation capabilities.

- Norway: Leading exporter of marine-derived omega-3 oils supported by strong fisheries, refining infrastructure, and regulatory oversight.

- Germany: Exporter of structured lipids and lipid delivery systems aligned with medical and functional nutrition standards.

- Netherlands: Exporter of lecithins, MCT oils, and lipid blends used across infant, clinical, and sports nutrition categories.

Top Importers (Demand Centres)

- United States: Significant importer of algal oils, specialty lipids, and encapsulated omega-3 ingredients used in dietary supplements and fortified foods.

- European Union: Strong intra-EU and extra-EU imports driven by infant nutrition, medical foods, and functional beverage production.

- China: Growing importer of DHA-rich oils and specialty lipid ingredients used in infant formula and maternal nutrition products.

- Japan: Imports high-purity lipid nutrition ingredients for clinical, elderly, and functional food applications.

Typical Trade Flows and Logistics Patterns

- Bulk marine and plant-based oils are shipped via containerized sea freight in drums or IBCs with oxidation-controlled packaging.

- Encapsulated and high-purity lipid ingredients are often shipped in smaller consignments to preserve stability and bioactivity.

- Temperature control and nitrogen flushing are commonly used to maintain product quality during transport.

- Regional blending and encapsulation facilities adapt lipid systems to local regulatory and formulation requirements.

Trade Drivers and Structural Factors

- Growth in infant, clinical, and functional nutrition drives sustained demand for specialty lipid ingredients.

- Rising awareness of cardiovascular, cognitive, and metabolic health increases adoption of omega-3 and MCT products.

- Stability and bioavailability challenges favor encapsulated and structured lipid systems.

- Volatility in marine raw material supply influences sourcing strategies and trade flows.

- Standardization by multinational nutrition brands concentrates demand among approved lipid suppliers.

Regulatory, Quality, and Market-Access Considerations

- Lipid nutrition ingredients must comply with food safety, novel food, or ingredient approval frameworks depending on jurisdiction.

- Oxidation limits, contaminant thresholds, and purity specifications influence trade eligibility.

- Infant and medical nutrition applications face stricter regulatory scrutiny and documentation requirements.

- Labeling, health claim authorization, and traceability requirements affect market access.

Government Initiatives and Public-Policy Influences

- Nutrition and public health policies promoting healthy fat intake indirectly stimulate demand for lipid nutrition ingredients.

- Infant nutrition regulations influence approval timelines and formulation requirements.

- Trade facilitation measures and customs harmonization affect cross-border movement of nutritional lipids.

Lipid Nutrition Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 10.94% |

| Market Size in 2026 | USD 15.40 Billion |

| Market Size in 2027 | USD 17.08 Billion |

| Market Size in 2030 | USD 23.33 Billion |

| Market Size by 2035 | USD 39.20 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Lipid Nutrition Market Segmental Analysis

Type Analysis

The omega-3 segment led the lipid nutrition market in 2025, due to its multiple health benefits for consumers of all age groups. Omega-3 is essential for consumers with cardiovascular, cognitive, and inflammatory issues in the body. Hence, it further helps to fuel the growth of the market. Availability of supplements, gummies, and functional food and beverages options enriched with omega-3 is another major factor helpful for the growth of the lipid nutrition industry. Increasing awareness among consumers through various and popular means, like social media and professional suggestions from medical experts regarding the health benefits of omega-3, also helps consumers to fuel the growth of the market.

The medium-chain triglycerides segment is expected to grow in the foreseen period due to high demand for food options consisting of MCT by consumers of different sectors. Consumers aiming for weight management, cognitive health benefits, diabetics, and consumers following a ketogenic diet help to fuel the growth of the market. The market also observes growth due to higher demand for MCT options, due to increasing health benefit awareness among consumers.

Source Analysis

The animal source dominated the lipid nutrition market in 2025, due to higher demand for animal-sourced lipids in various forms by consumers of different age groups. Higher demand for options such as dairy products, fish oil, and lipids derived from eggs also helps to fuel the growth of the market. Higher demand for options with a combination of lipids and omega-3 for multiple health benefits also helps to propel the growth of the lipid nutrition sector. Well-established supply chains and effective production are other major factors supporting the growth of the market.

The plant source segment is expected to grow in the forecast period due to the growing number of health-conscious consumers, vegans, and vegetarians. Hence, the crowd leads to higher demand for plant-based lipid options such as algae, chia seeds, and flaxseeds. These seeds are rich in protein and fiber, along with healthy fats, which help aid multiple health issues and provide relief from them. The market also observes growth due to rising consumer awareness regarding sustainability and ethical concerns. Their higher bioavailability is another major factor helping the growth of the lipid nutrition market in the foreseeable period.

Form Analysis

The liquid segment dominated the lipid nutrition market in 2025, due to the ease provided by the segment, allowing consumers to maintain their nutritional profile. Higher consumption of healthy smoothies, juices, and ready-to-drink supplements enriched with various lipids is another major factor fueling the growth of the market. Ease of adding lipid nutrition to various food and beverage options for easier consumption also helps to enhance the growth of the industry. The segment also observes growth due to higher demand for the segment by consumers with a hectic lifestyle to maintain their nutritional levels with ease.

The powder segment is observed to be the fastest-growing in the foreseen period due to higher demand for products such as infant formulas, protein blends, and powdered nutritional supplements. Its higher mixability and ease to add in various foods and beverages are another major factor for the growth of the lipid nutrition market in the foreseeable period. Longer shelf life, easy portability, and easy storage are also some of the beneficial highlights helpful for the growth of the market. Easy availability of the segment on multiple e-commerce platforms also enhances the growth of the segment.

Application Analysis

The dietary supplements and nutraceutical segment dominated the lipid nutrition market in 2025, due to higher demand for such supplements by consumers of different age groups, especially the aged. Growing health awareness and health and nutrition trends also help the growth of the market. Easy availability of MCT and omega-3 in various nutritional supplements in capsule and soft gel formats, along with various food and beverage options, also helps to fuel the growth of the market.

The infant formula segment is observed to be the fastest-growing in the foreseen period, mainly due to the growing use of MCT DHA and ARA oils globally for fortification. Higher demand for fortified and essential nutrients-enriched infant formula in urban areas due to multiple-income households is another major factor for the growth of the market. Hence, the segment has a major contribution to the growth of the market in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Dietary Supplements Market: The global dietary supplements market size is projected to reach USD 507.33 billion by 2035, growing from USD 229.77 billion in 2026, at a CAGR of 9.2% from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Lipid Nutrition Market Competitive Landscape: Top Companies and Strategic Positioning

- Clover Corporation Limited: Clover Corporation Limited specializes in structured lipid technologies, particularly DHA delivery systems for infant nutrition. Strategically, the company is a key supplier to global infant formula manufacturers, benefiting from strong intellectual property, regulatory alignment, and rising demand for high-bioavailability lipid ingredients.

- Croda International Plc: Croda International Plc provides high-purity lipid excipients and delivery systems used across nutrition and pharmaceutical applications. Its strategic value lies in advanced formulation expertise, sustainability-focused sourcing, and the ability to translate pharma-grade lipid technologies into nutrition markets.

- dsm-firmenich: dsm-firmenich is a global leader in omega-3 and nutritional lipid solutions serving supplements, infant nutrition, and medical foods. Strategically, the company sets industry standards through scientific validation, regulatory leadership, and scalable, integrated nutrition solutions.

- Enzymotec Ltd.: Enzymotec Ltd. focuses on structured lipids and specialty fatty acids, with a strong emphasis on infant nutrition. Its strategic importance comes from expertise in human milk fat analogs and tailored lipid systems aligned with tightening global infant nutrition regulations.

- FMC Corporation: FMC Corporation supports the lipid nutrition value chain through upstream agricultural and plant-based lipid inputs. Strategically, it contributes to supply stability and sustainability as demand increases for plant-derived and vegan lipid nutrition ingredients.

- FrieslandCampina Ingredients: FrieslandCampina Ingredients supplies dairy-based lipid solutions, including milk fat globule membrane (MFGM), for infant and adult nutrition. The company’s strategic strength lies in clinically supported dairy lipids and strong regulatory positioning in premium nutrition segments.

- GC Rieber VivoMega AS: GC Rieber VivoMega AS is a specialist producer of high-concentration marine omega-3 ingredients. Strategically, the company serves as a critical supplier for clinical-grade and high-potency omega-3 formulations in supplements and medical nutrition.

- KD Pharma Group: KD Pharma Group manufactures ultra-high-purity omega-3 concentrates for pharmaceutical and therapeutic use. Its strategic role is driven by expertise in regulatory compliance and purity, positioning it at the convergence of lipid nutrition and clinical applications.

- Kerry Group plc: Kerry Group plc delivers integrated lipid systems and functional nutrition solutions for food and beverage brands. Strategically, Kerry enables rapid commercialization of lipid-enriched products through formulation expertise, sensory science, and global manufacturing scale.

- Lecico GmbH: Lecico GmbH specializes in phospholipids and lecithins essential for lipid delivery and emulsification. Its strategic relevance is rising with increased demand for plant-based, clean-label, and bioavailability-enhancing lipid formulations.

-

Lonza Group AG: Lonza Group AG provides advanced lipid excipients, encapsulation technologies, and CDMO services. Strategically, Lonza supports precision lipid delivery and the convergence of nutrition and pharmaceutical standards in high-value lipid nutrition products.

Segments Covered in the Report

By Type

- Omerga-3

- Omega-6

- Medium-Chain Triglycerides

- Others

By Source

- Animal Source

- Plant Source

By Form

- Powder

- Liquid

By Application

- Dietary Supplements and Nutraceutical

- Pharmaceutical

- Infant Formula

- Animal Nutrition

- Food Fortification

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5975

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.